Every flu season, millions of people around the world reach for oseltamivir - better known by its brand name, Tamiflu. It’s not just another pill on the shelf. When a new strain of influenza spreads fast, hospitals stockpile it, governments release emergency supplies, and pharmacies run low within days. But behind the scenes, the global market for oseltamivir is far more complex than just filling prescriptions. It’s shaped by pandemics, patent cliffs, generic competition, and uneven access across countries. If you’re tracking how antiviral drugs move through the world’s health systems, oseltamivir is one of the clearest case studies you’ll find.

Oseltamivir: What It Is and How It Works

Oseltamivir is an oral antiviral medication that stops the influenza virus from spreading inside your body. It targets neuraminidase, a protein the flu virus needs to escape infected cells and infect new ones. When taken within 48 hours of symptom onset, it can shorten the illness by about a day and reduce the risk of complications like pneumonia - especially in high-risk groups like the elderly, pregnant women, and people with chronic conditions.

It’s not a cure. It doesn’t kill the virus outright. But it slows it down enough for your immune system to catch up. That’s why it’s used both for treatment and, in some cases, prevention during outbreaks. The World Health Organization lists it as an essential medicine - meaning it’s considered vital for basic healthcare systems.

Most oseltamivir sold today is generic. Roche’s original patent expired over a decade ago, and now more than 50 manufacturers in countries like India, China, Brazil, and South Africa produce it. That’s why the price dropped from over $100 per course in 2009 to under $5 in bulk purchases in low-income countries.

Market Growth Driven by Pandemic Preparedness

The global oseltamivir market was valued at around $1.2 billion in 2023 and is expected to hit $1.8 billion by 2028. That growth isn’t coming from more flu cases - it’s coming from better planning.

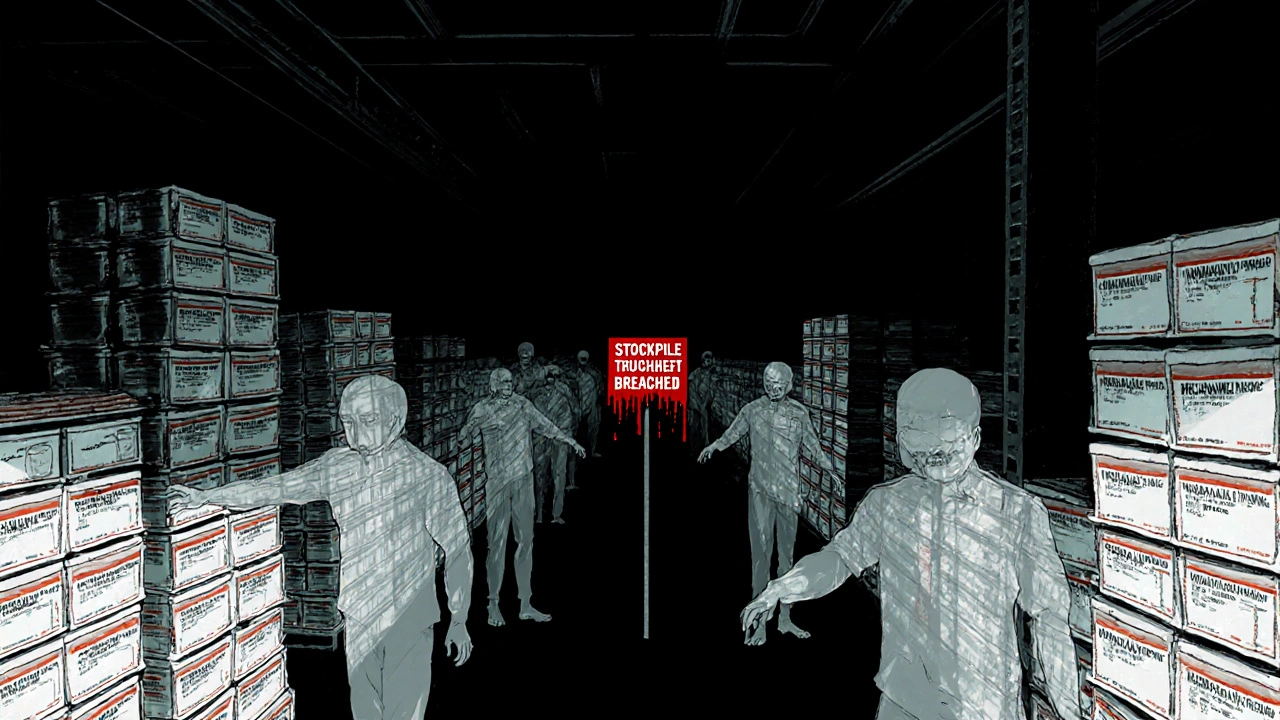

After the H1N1 pandemic in 2009 and the COVID-19 outbreak in 2020, governments realized they needed stockpiles of antivirals. The U.S. Strategic National Stockpile holds over 80 million courses of oseltamivir. The European Union has similar reserves. Australia, Canada, Japan, and South Korea all maintain national stockpiles large enough to cover 20-25% of their populations.

These aren’t just for emergencies. Many countries now use oseltamivir in seasonal flu response plans. During the 2023-2024 flu season, Australia distributed over 2 million courses through public health clinics, nearly double the amount from five years earlier. That’s because health officials now see antivirals as part of routine outbreak control - not just crisis response.

Challenges: Supply Chain Gaps and Unequal Access

Even with stockpiles, the system has cracks. In 2022, a surge in flu cases in Southeast Asia led to shortages in Indonesia and the Philippines. Local manufacturers couldn’t scale up fast enough. Raw materials like shikimic acid - the key ingredient derived from star anise - became scarce. Some countries had to delay shipments while waiting for new batches.

There’s also a huge gap between high-income and low-income nations. While the U.S. and EU have enough oseltamivir to treat 1 in 5 people, many African and South Asian countries have less than 1 course per 100 people. The WHO’s Global Influenza Surveillance and Response System (GISRS) tracks this imbalance, but funding to fix it remains limited.

And then there’s the problem of misuse. In some regions, oseltamivir is sold over the counter without a prescription. People take it for colds or even as a preventive during travel. That drives unnecessary demand and increases the risk of the virus developing resistance. A 2024 study in India found that 37% of oseltamivir prescriptions were for non-influenza illnesses.

Opportunities: Generics, New Formulations, and Global Partnerships

The biggest opportunity lies in making oseltamivir more accessible - and smarter.

Generic manufacturers are now producing pediatric suspensions and chewable tablets, making it easier to treat children. Some companies are testing dry powder inhalers, which could deliver the drug directly to the lungs - potentially more effective than swallowing a pill.

India’s Cipla and China’s Sinopharm are expanding production capacity with support from global health funds. In 2023, the Global Fund for Antivirals partnered with five manufacturers to build regional hubs in Africa and Latin America. These hubs will store bulk powder and convert it into finished tablets locally - cutting shipping time and cost.

There’s also growing interest in combining oseltamivir with other antivirals like baloxavir. Early trials show that using both drugs together reduces hospitalization rates by 40% in high-risk patients. If approved, this could become the new standard of care.

Regulatory and Pricing Pressures

Regulators are stepping in. The U.S. FDA now requires manufacturers to report inventory levels quarterly. The European Medicines Agency has set minimum stockpile thresholds for member states. In Brazil, the government caps the price of generic oseltamivir at 12 reais ($2.30) per course - a move that increased usage by 60% in public clinics.

But pricing isn’t always straightforward. In some countries, even cheap generics are out of reach because of distribution costs. In rural Nigeria, a $2 pill can cost $8 by the time it reaches a village pharmacy. That’s why some NGOs are testing mobile distribution networks - using motorbike couriers to deliver antivirals directly from regional warehouses.

What’s Next? The Future of Influenza Treatment

Oseltamivir won’t be the last word in flu treatment. New drugs are coming. Vaccines are getting better. But for now, it remains the most widely used, most studied, and most accessible antiviral for influenza.

The real question isn’t whether oseltamivir will disappear. It’s whether the world will finally fix the systems that leave millions without access to it when they need it most. The technology exists. The manufacturing capacity exists. What’s missing is consistent funding, coordinated logistics, and political will.

As climate change shifts flu patterns and urbanization increases transmission risks, the demand for oseltamivir isn’t going down. It’s going up. The next pandemic won’t wait for us to catch up. The global market for oseltamivir isn’t just about profit - it’s about preparedness. And right now, we’re still playing catch-up.

Is oseltamivir still effective against current flu strains?

Yes, oseltamivir remains effective against most circulating influenza A and B strains as of 2025. Surveillance data from the CDC and WHO shows resistance rates remain below 2% in most countries. However, resistance can emerge in isolated cases - especially when the drug is misused or taken incorrectly. Regular monitoring by public health agencies ensures early detection and updated treatment guidelines.

Can I buy oseltamivir without a prescription?

In some countries like India, Mexico, and parts of Southeast Asia, oseltamivir is available over the counter. But in the U.S., Canada, Australia, and most of Europe, it requires a prescription. Even where it’s available without one, health experts strongly advise against self-medication. Taking it for a cold or without confirmed flu symptoms can lead to resistance and delay proper care.

Why is oseltamivir so much cheaper in some countries?

The price difference comes down to generics, bulk purchasing, and government negotiation. In low- and middle-income countries, public health agencies buy oseltamivir in massive quantities - often millions of doses at a time - directly from manufacturers in India and China. These bulk deals can bring the cost down to under $1 per course. In contrast, retail prices in the U.S. can be $70-$150 because of pharmacy markups and lack of centralized purchasing.

Are there alternatives to oseltamivir for treating the flu?

Yes. Baloxavir marboxil (Xofluza) is a newer antiviral that works differently - it stops the virus from copying its genetic material. It’s taken as a single dose and works faster than oseltamivir. Zanamivir (Relenza) is an inhaled option, but it’s less convenient and not suitable for people with asthma. While these alternatives exist, oseltamivir remains the most widely used because it’s oral, affordable, and well-studied.

How long does oseltamivir stay in your system?

Oseltamivir is metabolized quickly. The active form, oseltamivir carboxylate, reaches peak levels in the blood within 3-4 hours after taking a dose. It has a half-life of about 6-10 hours, meaning most of it is cleared from your body within 24-48 hours. That’s why it’s typically taken twice a day for five days - to keep enough drug in your system to suppress the virus.

Cecil Mays

October 29, 2025 AT 02:06Sarah Schmidt

October 30, 2025 AT 18:42Billy Gambino

October 31, 2025 AT 23:23Karen Werling

November 2, 2025 AT 14:45STEVEN SHELLEY

November 4, 2025 AT 03:32Emil Tompkins

November 5, 2025 AT 19:16Kevin Stone

November 6, 2025 AT 06:41Natalie Eippert

November 6, 2025 AT 16:20kendall miles

November 8, 2025 AT 07:22Gary Fitsimmons

November 8, 2025 AT 13:10Bob Martin

November 10, 2025 AT 03:07Sage Druce

November 10, 2025 AT 11:03Raj Modi

November 11, 2025 AT 06:39Tyler Mofield

November 13, 2025 AT 00:02