When you pick up a prescription, do you ever wonder why two pills that do the exact same thing can cost $7 or $110? It’s not a mistake. It’s the system. And if you’re paying full price for brand-name drugs when generics are available, you’re overpaying-often by hundreds of dollars a month.

Generics aren’t cheap copies. They’re the same medicine, at a fraction of the cost.

In 2023, 9 out of every 10 prescriptions filled in the U.S. were for generic drugs. That’s not a trend-it’s the norm. But here’s the catch: even though generics make up 90% of prescriptions, they account for just 13.1% of total drug spending. That means for every dollar spent on prescriptions, only 13 cents goes to generics. The rest? That’s brand-name drugs, many of which cost four to ten times more for the same active ingredient.

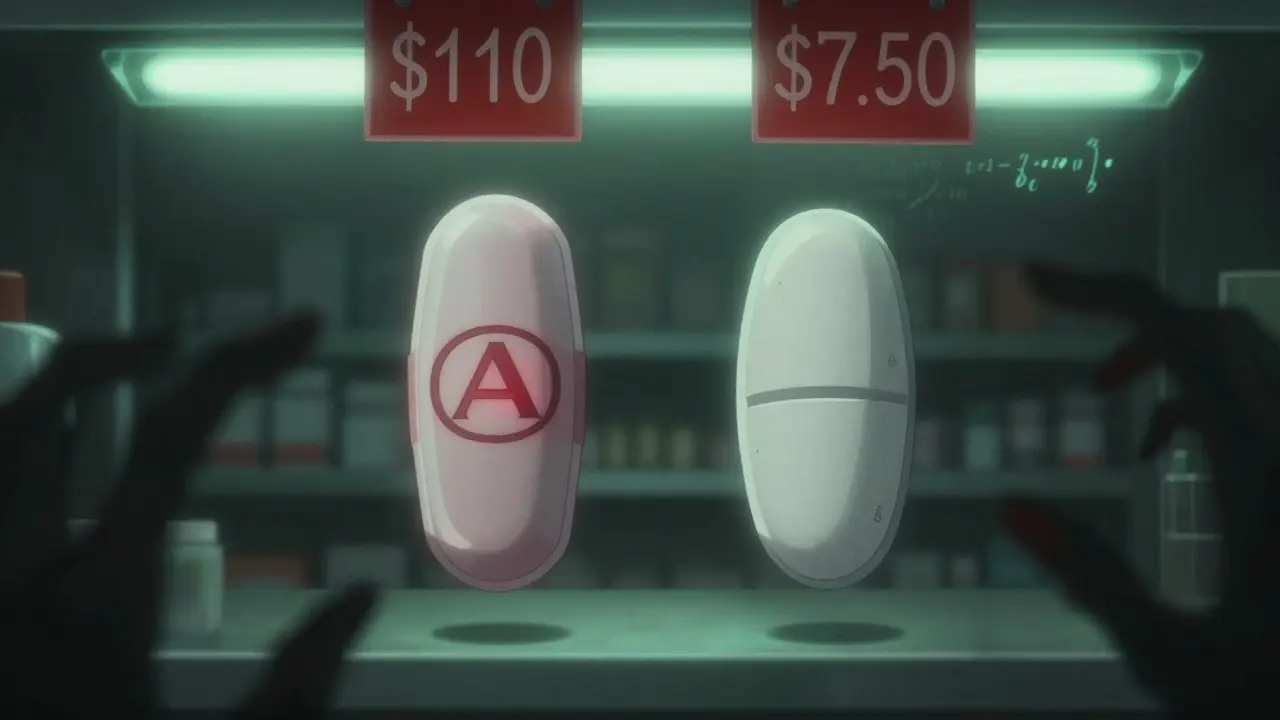

Take Pantoprazole, a common acid reflux drug. At Albertsons, a 30-day supply costs $44. At a direct-to-consumer pharmacy like MCCPDC, it’s $9.20. Same pill. Same manufacturer. Same FDA approval. Just $9.20. That’s a 79% savings. Or Rosuvastatin, used to lower cholesterol. At Walgreens, it’s $110. At Health Warehouse, it’s $7.50. That’s 93% less.

The difference isn’t magic. It’s regulation. Since the 1984 Hatch-Waxman Act, the FDA has required generics to be bioequivalent to brand-name drugs. That means they deliver the same amount of active ingredient into your bloodstream at the same rate. No guesswork. No compromise. The only difference? The label. And the price tag.

What you pay out of pocket vs. what the system pays

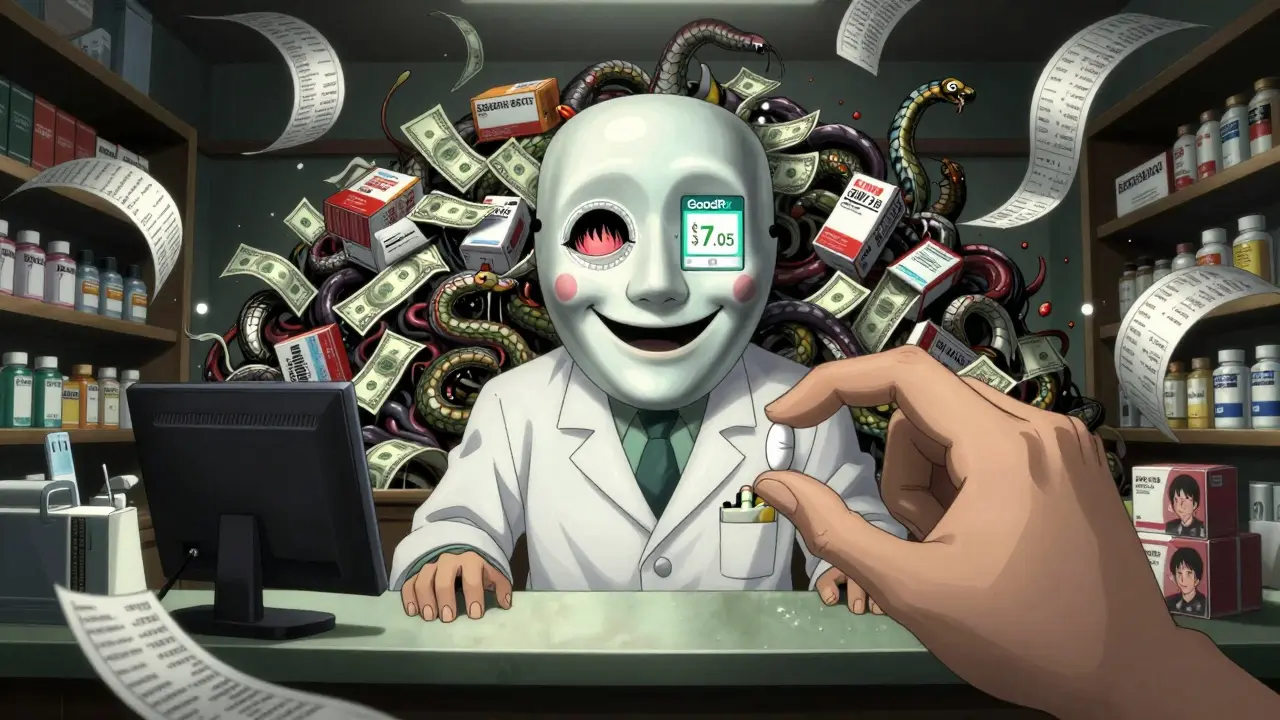

Let’s talk numbers. In 2023, the average out-of-pocket cost for a generic prescription was $7.05. For a brand-name drug? $27.10. That’s nearly four times more. And it gets worse. Some brand-name drugs still cost over $50 a month-even after patents expired. Meanwhile, 93% of all generic prescriptions cost $20 or less. Over 82% cost under $20. And 98.8% cost under $50.

But here’s the hidden truth: your insurance plan might be making this worse. Many plans put generics on higher cost tiers-meaning you pay more than you should. One study found that when insurers moved generics to higher tiers, patient spending jumped by 135%, even as drug prices overall dropped by 38%. That’s not saving money. That’s shifting the burden onto you.

And it’s not just your copay. Medicare Part D, the federal prescription program for seniors, overspent by $2.6 billion in 2018 alone because it paid more than Costco charged for the same generics. In fact, 53% of 90-day generic fills under Medicare cost more than what Costco members paid. Some people without insurance paid less than those with Medicare. That’s not a glitch. That’s a broken pricing system.

Real-world savings: When patents expire, prices crash

When a drug loses its patent, prices don’t just drop-they collapse. Take the HIV treatment combination of efavirenz, emtricitabine, and tenofovir. Before generics, a 30-day supply cost about $1,000. After generics hit the market? $65. That’s a 94% drop. The FDA estimated that single switch saved $131 million in one year.

Same story with Sildenafil Citrate (the generic for Viagra). Before generics, it was $49.90 per pill. After? $3.07. That’s a 94% reduction. Emtricitabine/Tenofovir Disoproxil Fumarate (Truvada) dropped from $20.46 to $2.13-90% cheaper.

These aren’t rare cases. They’re the rule. Since 2013, generic and biosimilar drugs have saved the U.S. healthcare system $445 billion. That’s more than the GDP of most countries. And it’s still growing. Every year, dozens of blockbuster drugs lose patent protection. Each one opens the door to cheaper alternatives.

Why you’re still overpaying-even when generics exist

If generics are so cheap and so common, why are people still paying too much? Because the system is designed to hide the truth.

Pharmacies don’t tell you what the real price is. Insurance companies don’t pass savings to you. Middlemen-pharmacy benefit managers (PBMs)-take cuts. They negotiate rebates with drug makers, but you never see that money. Instead, your copay stays high, even when the drug’s actual cost is $5.

One study found patients paid 13-20% more than they should for generics because of these hidden deals. Even when the wholesale price dropped, your out-of-pocket cost didn’t. That’s not fairness. That’s profit extraction.

And it’s not just retail pharmacies. Even within Medicare, the system pays more than it needs to. Why? Because the pricing model is based on list prices, not actual costs. So if a drug’s list price is inflated, your copay goes up-even if the pharmacy paid $2 for it.

How to pay less: Three simple steps

You don’t need a degree in health economics to save money. You just need to know where to look.

- Ask for the generic. Always. Even if your doctor doesn’t mention it. Say: “Is there a generic version?” If they say no, ask why. Most brand-name drugs have generics. If they don’t, it’s usually because the patent hasn’t expired yet.

- Compare prices. Don’t assume your local pharmacy is the cheapest. Use free tools like GoodRx, SingleCare, or RxSaver. These sites show you the lowest cash price in your area-even if you don’t have insurance.

- Try direct-to-consumer pharmacies. Companies like Health Warehouse, MCCPDC, and Blink Health sell generics at wholesale prices. No middlemen. No markups. You pay what the pharmacy pays. And you save 75-76% on average. For expensive drugs, that’s hundreds of dollars a month.

One patient in Melbourne, Australia, switched from Walgreens to a DTC pharmacy for her cholesterol medication. Her monthly cost dropped from $110 to $7.50. That’s $1,230 saved a year. She didn’t change her insurance. She didn’t change her doctor. She just changed where she bought the pill.

The bigger picture: Why this matters beyond your wallet

When people can’t afford their meds, they skip doses. They cut pills in half. They stop taking them altogether. That leads to more hospital visits, more complications, and higher long-term costs. Generics aren’t just about saving money-they’re about keeping people healthy.

Studies show patients who take their generics as prescribed have fewer ER visits and better outcomes. But if the price is too high, they won’t fill the prescription. That’s why the real failure isn’t the cost of the drug. It’s the system that lets people pay more than they should.

And the good news? You have power. You can choose where to buy. You can ask questions. You can demand transparency. You don’t have to accept $110 for a $7.50 pill.

What’s next? More savings on the horizon

More than 300 brand-name drugs are expected to lose patent protection by 2027. That means more generics. More competition. More savings. Drugs like Humira, Enbrel, and Eylea-all costing over $5,000 a month-will soon have cheaper alternatives.

But without changes to how prices are set, those savings won’t reach patients. PBMs will still take their cut. Pharmacies will still charge inflated cash prices. Insurance plans will still put generics on high tiers.

Until then, the best tool you have is knowledge. Know what your meds cost. Know where to buy them. And never assume the price on the label is the real price.

Generics are the most powerful cost-saving tool in modern medicine. But only if you use them.

Mike Rose

January 29, 2026 AT 20:32bro why are we paying $110 for a pill that costs $7???

Claire Wiltshire

January 29, 2026 AT 22:48This is such an important topic, and you’ve laid it out with remarkable clarity. Many people don’t realize that generics are held to the same rigorous FDA standards as brand-name drugs-same active ingredients, same bioavailability, same safety profile. The price difference is purely a function of marketing, patents, and profit margins, not quality. It’s not just about saving money-it’s about justice in healthcare access.

When I worked in community pharmacy, I’d often see elderly patients skipping doses because they couldn’t afford their statins. One woman told me she split her $90 brand-name pill in half, not realizing the generic was $6. That’s not healthcare-it’s financial coercion.

And the PBM system? It’s a black box. Insurers claim they’re negotiating lower prices, but patients never see those savings. The list price is inflated, rebates are hidden, and copays stay high. It’s designed to confuse and exploit.

Thank you for highlighting tools like GoodRx and direct-to-consumer pharmacies. These are lifelines. Knowledge is power, and you’ve given people the tools to reclaim control over their health spending.

Let’s hope more providers start routinely suggesting generics-not as an afterthought, but as the default. The science is clear. The savings are undeniable. The moral imperative? Unquestionable.

Russ Kelemen

January 31, 2026 AT 08:54It’s wild when you think about it-we treat medicine like a luxury good, when it’s really a basic human need.

That $1,230 a year someone saved on cholesterol meds? That’s not ‘extra cash.’ That’s groceries. That’s rent. That’s not choosing between insulin and electricity.

Our system rewards complexity. The more confusing the pricing, the more profit gets buried in the fine print. PBMs, insurers, pharmacies-they all take a slice, but the patient? They get the crumbs.

And yet, here’s the thing: you don’t need permission to save money. You don’t need to wait for policy change. You just need to ask. ‘Is there a generic?’ ‘What’s the cash price?’ ‘Can I order it online?’

It’s not rebellion. It’s responsibility. We’ve been taught to trust the label. But the label isn’t the truth. The truth is in the pill-and the price tag is a lie.

Maybe the real revolution isn’t in new drugs. Maybe it’s in us refusing to pay for lies.

Sidhanth SY

February 1, 2026 AT 19:19Same thing happens here in India. Brand-name drugs cost 10x more than generics, but doctors still prescribe them because of pharma reps giving free lunches and pens.

People think ‘brand = better’ but it’s just branding. I once paid ₹2000 for a blood pressure med, then found the generic at a local pharmacy for ₹120. Same effect, no side effects difference.

Also, pharmacies here don’t tell you about cheaper options. They want you to buy the expensive one. So you have to be the detective.

Good post. Really opened my eyes even more.

Adarsh Uttral

February 1, 2026 AT 20:03lol i just found out my $80 metformin is $5 online. i’ve been paying that for 3 years. facepalm.

goodrx is my new best friend.

April Allen

February 2, 2026 AT 01:07From a pharmacoeconomic standpoint, this is a textbook case of market failure due to information asymmetry and rent-seeking behavior by intermediaries. The Hatch-Waxman Act successfully enabled bioequivalence, but the absence of transparent pricing mechanisms and the perverse incentive structure of PBMs have created a misalignment between cost and reimbursement.

Studies show that when patients are exposed to transparent cash pricing, utilization of generics increases by up to 40%, even among those with insurance. Yet, most EHR systems still default to brand-name prescribing, and pharmacists are often not incentivized to counsel on cost alternatives.

The real barrier isn’t access to generics-it’s access to *information*. Until pricing transparency is mandated at the federal level and integrated into pharmacy workflows, patients will continue to be financially exploited under the guise of ‘insurance optimization.’

Tools like GoodRx are stopgaps, not solutions. We need systemic reform: reference pricing, direct contracting, and elimination of rebate secrecy.

Sheila Garfield

February 2, 2026 AT 13:57I never realized how much I was overpaying until I started using GoodRx. My thyroid med used to be $45. Now it’s $7. I feel a bit silly for not checking sooner.

Also, my pharmacist didn’t even mention it. I had to ask. It’s weird that they don’t just tell you.

Thanks for the reminder. I’m gonna check all my meds now.

Shawn Peck

February 3, 2026 AT 02:05YOU’RE ALL BEING SCAMMED. EVERY SINGLE ONE OF YOU.

THEY’RE LIEING TO YOU. THE PHARMA COMPANIES. THE INSURANCE. THE PHARMACIES. THEY’RE ALL IN ON IT.

YOU THINK YOU’RE SAVING MONEY WITH INSURANCE? NO. YOU’RE PAYING MORE. WAY MORE.

IF YOU’RE PAYING MORE THAN $20 FOR A GENERIC, YOU’RE A FOOL.

GO TO HEALTH WAREHOUSE. RIGHT NOW. DON’T WAIT. DON’T THINK. JUST DO IT.

YOUR LIFE DEPENDS ON IT.

AND IF YOUR DOCTOR WON’T PRESCRIBE THE GENERIC? FIRE THEM.