When you walk into a pharmacy and see a prescription priced at $5 instead of $500, you’re seeing the result of something much bigger than a discount coupon. You’re seeing the power of generic drug competition-a quiet but powerful force that reshapes how medicines are priced across the entire health system.

Why Generic Drugs Change Everything

Generic drugs aren’t just cheaper versions of brand-name pills. They’re legally identical in active ingredients, dosage, safety, and effectiveness. The only difference? Cost. And that difference is massive. When a drug loses its patent, generic manufacturers jump in. One competitor might bring the price down to 30% of the brand. Two? Maybe 20%. By the time six or more generics are on the market, prices often drop to just 5% of the original-sometimes even lower. The FDA tracked this trend across 2,400 new generic approvals between 2018 and 2020. The data didn’t lie: each new generic competitor pushed prices down further. For drugs with nine generic versions, prices fell by 97.3% on average. That’s not a sale. That’s a revolution. And it’s not just about the patient’s out-of-pocket cost. It’s about what insurers, Medicare, and state health programs pay. When a drug like metformin has 50 generic makers, no one can charge more than a few cents per pill. The market sets the price, not the manufacturer.How Buyers Use This Competition to Negotiate

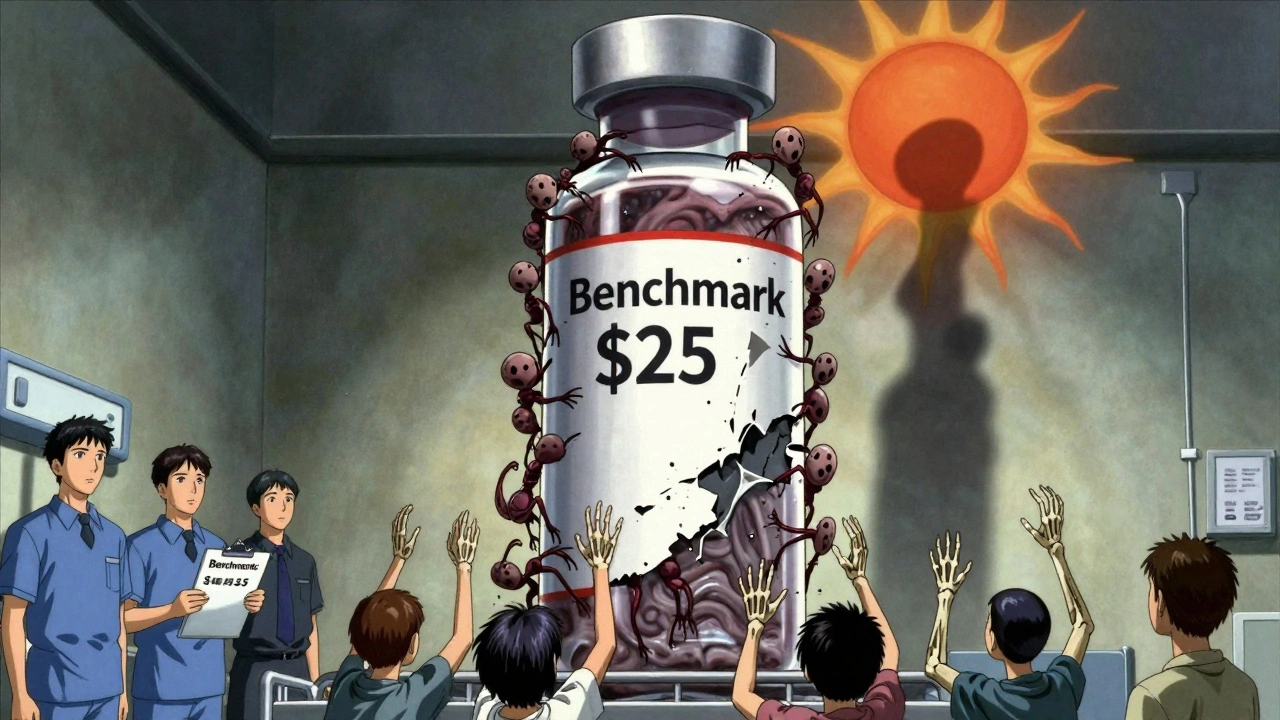

Buyers-whether it’s Medicare, a private insurer, or a hospital system-don’t just accept whatever price is offered. They use the existence of generics as leverage. Think of it like shopping for a TV. If you know five brands sell the same model for $200, you’re not going to pay $500 for one. In the U.S., Medicare’s new price negotiation program under the Inflation Reduction Act doesn’t directly negotiate with generic manufacturers. But it uses generic prices as a baseline. If a brand-name drug like insulin has five generic alternatives selling for $25 a month, Medicare won’t pay $300 for the brand. It starts its offer at $25, then adjusts slightly based on clinical data. That’s not a guess. It’s a market signal. Private payers and pharmacy benefit managers (PBMs) do the same thing. They use data from the Average Manufacturer Price (AMP) and Prescription Drug Event (PDE) records to see exactly what generics are selling for. Then they tell brand-name companies: “Here’s what the market will bear. If you want to stay in our formulary, match it.” Some buyers go further. Canada uses a tiered pricing system: the more generic competitors a drug has, the lower the maximum price allowed. It’s like a sliding scale. One generic? $100. Five generics? $20. It forces companies to compete or get priced out.What Happens When Competition Is Blocked

But competition doesn’t always win. Brand-name companies have spent decades finding ways to delay generics. One common trick? “Product hopping.” That’s when a company slightly changes a drug-say, switches from a pill to a capsule-and pushes doctors to prescribe the new version. Suddenly, the old generic version is useless. Patients are locked in. The FTC found 1,247 of these maneuvers between 2015 and 2020. Another tactic? “Reverse payments.” A brand-name company pays a generic maker to stay out of the market. The FTC recorded 106 such deals between 2010 and 2020. In one case, a generic maker was paid $100 million to delay launching a cheaper version of a heart drug for two years. That’s not competition. That’s collusion. These tactics cost patients and systems billions. When a generic is delayed by even six months, Medicare pays an extra $200 million on average for that drug. That’s money that could’ve gone to care, not corporate profits.

The Medicare Negotiation Program and the Generic Paradox

The Inflation Reduction Act gave Medicare the power to negotiate prices for 10 high-cost drugs starting in 2026. But there’s a catch. The law says Medicare can’t negotiate with drugs that already have generic competition. That sounds fair-why pay more if cheaper options exist? But here’s the twist: Medicare can still use generic prices to set the starting point for brand-name drug negotiations. That means even if a brand has no generics yet, if one is coming, Medicare can say, “We’ll pay what the generic will cost.” This creates a dilemma. If Medicare sets a low price before generics enter, generic manufacturers might decide it’s not worth the risk. Why spend $50 million on legal battles and manufacturing if the government will cap the price at $10, and you still have to compete with that same $10 price? That’s called a “chilling effect.” Avalere Health and Matrix Global Advisors warn that if Medicare sets prices too early, it could discourage generic entry altogether. The result? Fewer competitors, higher prices long-term. The goal is to lower costs, but bad timing could backfire.Who Wins and Who Loses

Patients win when generics flood the market. In the U.S., 90% of prescriptions are filled with generics-but they make up only 22% of total drug spending. That’s the power of competition. AARP estimates Medicare beneficiaries will save $6.8 billion in the first year of the new negotiation program alone. Generic manufacturers win when the rules are clear. Canada’s system gives them predictable pricing based on competitor count. European generic makers say 78% of them need stable pricing to invest in production. Without that, they can’t afford to build new factories or hire chemists. But brand-name companies lose. They’ve built business models around patent monopolies. When a drug loses exclusivity, revenue can drop 90% in a year. That’s why PhRMA spent over $300 million lobbying against Medicare negotiation in 2023. They’re not against generics-they’re against losing control. The real losers? Patients in countries with weak competition. Japan has only 58% generic market share. Germany has 72%. The U.S. leads with 90%. Why? Because the U.S. system, despite its flaws, allows faster generic entry and more legal challenges to patents. That’s thanks to the Hatch-Waxman Act of 1984, which gave generic makers a clear path to market.

The Future: Complex Generics and Biosimilars

Not all drugs are created equal. Simple pills like lisinopril or atorvastatin are easy to copy. But complex drugs-like inhalers, injectables, or biologics-are harder. That’s where biosimilars come in. These are generic versions of biologic drugs, which are made from living cells, not chemicals. The problem? Biosimilars take longer to develop, cost more to produce, and face more regulatory hurdles. So far, they’ve only captured 45% of the market, compared to 90% for traditional generics. That means price drops are slower. Health systems are starting to adapt. By 2025, 73% of health technology agencies plan to use real-world data-like how well a drug works in actual clinics-to guide pricing. That could help justify higher prices for complex generics if they deliver better outcomes. But without strong competition, even biosimilars won’t drive prices down enough. The key remains: more manufacturers. More choices. More pressure.What Works-and What Doesn’t

Here’s what drives real price reductions:- Multiple generic manufacturers entering the market

- Fast approval of generic applications by the FDA

- Legal challenges to weak patents (Paragraph IV filings cut delays by 62 months on average)

- Transparency in pricing data (AMP and PDE records)

- Payers using generic prices as negotiation anchors

- Reverse payment settlements

- Product hopping and evergreening

- Government setting prices before generics enter

- Lack of data sharing between payers and manufacturers

- Complex drugs with high barriers to entry

What You Can Do

If you’re a patient, ask your pharmacist: “Is there a generic version?” If your insurance won’t cover it, ask why. If you’re a policymaker, support faster generic approvals and ban reverse payments. If you’re a provider, prescribe generics when appropriate. The system isn’t perfect. But when competition is allowed to work, it works better than any law, any negotiation, or any price cap ever could.Generic drugs aren’t just affordable. They’re the most effective tool we have to bring down the cost of medicine. And the more buyers use that competition as leverage, the more patients win.

How do generic drugs lower prices so dramatically?

Generic drugs lower prices because multiple manufacturers can produce the same medicine after a patent expires. With no R&D costs to recoup and intense competition, prices drop fast. One generic might cut the price by 70%. Six generics? Often 90% or more. The FDA found that drugs with nine generic competitors saw price drops of 97.3% on average.

Does Medicare negotiate prices with generic drug makers?

No, Medicare doesn’t directly negotiate with generic manufacturers. But it uses the prices of existing generics as a benchmark to set starting prices for brand-name drugs. If a generic version of a drug sells for $15, Medicare won’t pay $300 for the brand-it uses that $15 as a baseline and adjusts slightly based on clinical data.

Why do some brand-name companies pay generic makers to stay out of the market?

These are called reverse payment settlements. A brand-name company pays a generic manufacturer to delay launching a cheaper version of the drug. The FTC found 106 such deals between 2010 and 2020. This protects the brand’s monopoly and keeps prices high. It’s legal in the U.S. but banned in the EU and under scrutiny by lawmakers.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs made from chemicals-like metformin or lisinopril. Biosimilars are similar but not identical copies of complex biologic drugs made from living cells-like insulin or Humira. Biosimilars are harder and more expensive to make, so they enter the market slower and achieve only 45% market share, compared to 90% for traditional generics.

Can government price setting hurt generic competition?

Yes. If the government sets a low price for a brand-name drug before generics enter the market, generic manufacturers may decide it’s not worth the cost to enter. They’d have to compete with both the brand and the government-set price, making it hard to recover development and legal costs. This is called a “chilling effect,” and experts warn it could reduce future generic entry.

Which countries use generic competition to drive down drug prices?

The U.S. leads with 90% generic market share due to its Hatch-Waxman Act and fast FDA approvals. Canada uses tiered pricing-lower maximum prices as more generics enter. The UK and Germany use reference pricing based on prices in other countries. Japan has lower generic use (58%) due to cultural and pricing system differences.

Deborah Jacobs

December 6, 2025 AT 00:57Can we just take a second to appreciate how wild it is that a pill you can buy for five bucks used to cost a thousand? It’s not magic-it’s competition. And it’s beautiful. I used to think drugs were just expensive because they’re science. Turns out they’re expensive because someone was holding the market hostage.

sean whitfield

December 6, 2025 AT 09:00the government will set prices but wont negotiate with generics?? lol. classic. next theyll say theyre protecting innovation while letting big pharma bribe generics to stay away. dont be fooled. this is all a show. they want you to think its working while the real players laugh all the way to the bank

ashlie perry

December 6, 2025 AT 13:47theyre coming for your insulin next then theyll come for your blood pressure meds then your antidepressants then your birth control then your allergy pills then your vitamins then your water then your air

William Chin

December 6, 2025 AT 21:36The assertion that generic competition naturally lowers prices is a textbook economic fallacy. In reality, the FDA’s approval process is manipulated by regulatory capture-pharma lobbyists draft the guidelines. The 97.3% drop cited is cherry-picked from low-cost, high-volume generics. Complex drugs, biologics, and specialty medications are where the real profits lie, and those are shielded by layers of litigation and patent thickets. This narrative is designed to distract from the fact that Medicare’s price-setting authority is a Trojan horse for centralized control.

Ali Bradshaw

December 8, 2025 AT 18:09My dad’s metformin costs $4 at Walmart. Same pill, same factory, same everything. Just no marketing budget. Makes you wonder why we ever paid $500 in the first place. Honestly? It’s not that hard. Just let people compete.

Stephanie Fiero

December 10, 2025 AT 01:51ok so i just went to my local pharmacy and asked about my blood pressure med and they said oh its generic now its 5 bucks but my insurance still wants me to pay 20 because theyre not updating their formulary?? like?? what is this 1999?? we have apps for this. why is this still broken??

Marvin Gordon

December 11, 2025 AT 07:43Generics work because the system allows them to. The Hatch-Waxman Act was genius. It didn’t force prices down-it created a race. And the market won. No government mandate needed. That’s the lesson here: freedom to compete beats bureaucracy every time. Stop trying to fix what’s already working.

Jennifer Patrician

December 12, 2025 AT 03:57you think this is about competition? nah. this is about the FDA and big pharma running a cartel. they let generics in but only when its convenient. watch what happens when a new cancer drug hits the market-same thing. patents extended. lawsuits filed. generics delayed. theyre not afraid of competition-theyre afraid of transparency. and theyre scared you’ll figure out how much they’ve been lying to you for 30 years

Rupa DasGupta

December 12, 2025 AT 12:19why do i feel like im being gaslit?? i just paid $80 for a generic and my friend in canada paid $2 for the same thing?? and you’re telling me this is fair?? 🤡💸

Michael Dioso

December 14, 2025 AT 08:58you think generics are the hero? think again. they’re just the second wave of the same corporate machine. the real villains are the PBMs-those middlemen who pocket the difference. they’re the ones negotiating behind closed doors. the generics? they’re just pawns. the system’s rigged from the start. you’re mad at the wrong enemy.

Krishan Patel

December 16, 2025 AT 08:48Let me be clear: the U.S. system is not superior. It is chaotic, inefficient, and ethically bankrupt. In India, generics are produced at 1/100th the cost, and the government ensures equitable access. Here, we celebrate low prices while allowing insurance companies to exploit patients with co-pays. We have the technology. We have the will. We lack the moral courage.

Kylee Gregory

December 17, 2025 AT 18:37I think the real win here isn’t just lower prices-it’s that patients are finally being treated like rational actors. We’re not just consumers. We’re people who need medicine. When competition works, it doesn’t just save money-it restores dignity. Maybe that’s the quiet revolution.

Lucy Kavanagh

December 19, 2025 AT 16:14did you know that the FDA gets funding from pharma companies? yeah. they pay user fees. so when they approve a generic faster? maybe its because the company paid extra. and when they delay? maybe the brand paid to keep it quiet. this isnt freedom. its a pay-to-play system. and you’re the one paying

James Moore

December 20, 2025 AT 13:51It is not merely a question of competition-it is a question of sovereignty. When a nation allows its citizens’ health to be dictated by market forces alone, it surrenders its moral authority. The pharmaceutical industry is not a grocery store. Medicine is not a commodity. To treat it as such is to reduce human life to a line item on a balance sheet. The FDA’s role is not to facilitate commodification-it is to protect the sanctity of life. And yet, we cheer when a pill drops from $500 to $5, as if that were redemption. It is not. It is merely the echo of a system that still lets the powerful profit from pain.

Chris Brown

December 20, 2025 AT 21:17They’ll let you buy generics for $5… but only if you’re lucky enough to have insurance that covers them. What about the 30 million Americans without coverage? What about the ones who skip doses because they can’t afford even $5? This isn’t a victory-it’s a cruel joke. The system didn’t fix anything. It just made the rich feel better about their $0.50 co-pay.